⚡ The Signal (TL;DR)

The News: The latest market movements confirm a split in the procurement stack. While "Intake" has matured, investor capital is aggressively moving toward Agentic AI (systems that do the work).

The Data: Zip has cemented its status as the "Orchestration" winner, raising $190M at a $2.2B valuation and confirming over $4.4 billion in customer savings as of late 2024.

The Shift: The market is pivoting from "Chat" to "Action." European autonomous negotiator Pactum secured the "Future Unicorn Award" from DigitalEurope, signaling that tools capable of autonomous negotiation are the next frontier.

🧠 The Procurement Takeaway

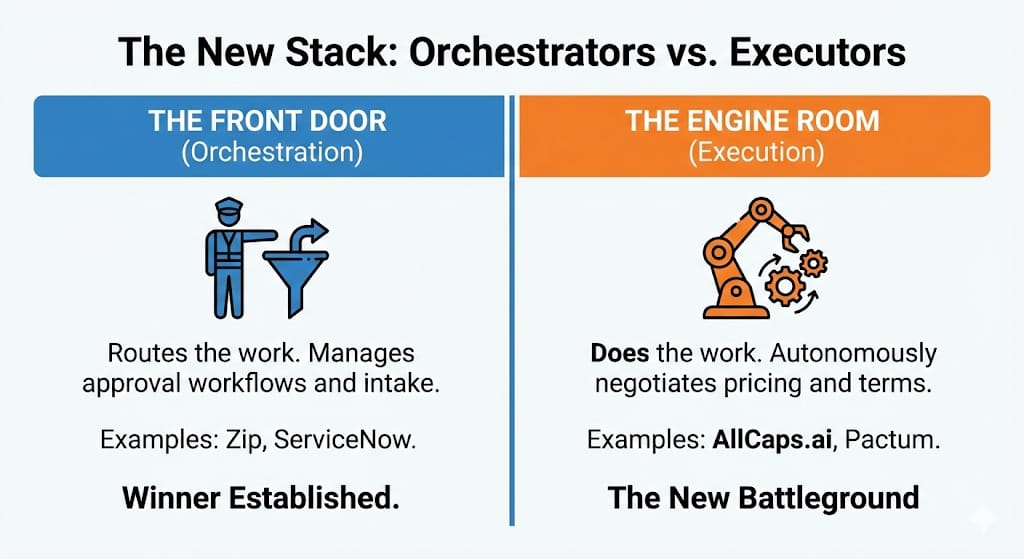

The "Intake War" is effectively settled. The "Execution War" is the new front.

For the last 24 months, the industry obsessed over the "Front Door"—solving the user experience problem. Zip emerged as the clear winner here, moving from a disruptor to the standard orchestration layer.

Now, the battleground has shifted to Execution.

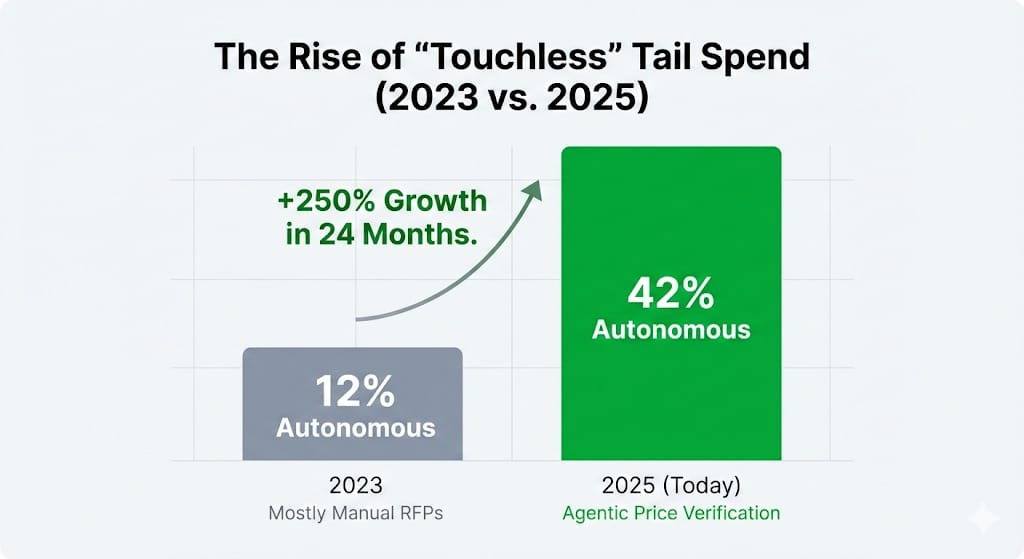

According to the 2024 Gartner Hype Cycle, we are seeing a crucial divergence:

Generative AI (Content Creation) has reached the Peak of Inflated Expectations, with teams realizing it requires heavy governance.

Agentic AI (Autonomous Action) is the emerging breakout capability, designed to monitor risk and execute tasks without human intervention.

The Reality Check: The new stack has two layers. You need an Orchestrator (like Zip) to route the work, and Executors (like AllCaps.ai or Pactum.ai ) to do the work. If your roadmap only focuses on "Intake," you are solving yesterday's problem.

While legacy players like Coupa and SAP are still rolling out "Copilots" (assistants that help you work), the market is aggressively moving toward "Autopilots" (agents that do the work).

Market Signal: Watch the valuation gap widen between "Workflow" tools and "Outcome" tools. Investors are pouring capital into Autonomous Execution platforms—specifically AllCaps.ai (Negotiation) and Pactum (Chat-based sourcing)—because they don't just save time; they generate hard-dollar savings that CFOs can audit.

The Reality Check: If your category managers are still manually reviewing NDAs or negotiating sub-$50k SaaS renewals, your cost structure is officially obsolete.